Many medical technology companies, particularly those that produce innovative implantable devices, are looking to fuel their continued growth by engaging with healthcare professionals beyond the implanting team at the hospital. In practice this strategy often requires encouraging office-based referring physicians to screen, diagnose and refer patients for surgical procedures, where previously those patients would remain undiagnosed or on prescribed pharmaceutical products.

Market development and therapy development are C-level priorities, discussed in medtech companies’ earnings presentations, at investor days and healthcare conferences. They are also a daily theme for these companies’ sales and marketing leaders, many of whom recognize the need to take an increasingly proactive approach to market development and referrer engagement.

However, directly engaging with referring physicians in an office-based setting is out of most medtech companies’ comfort zones, and significant effort is often required to convince a fragmented and dispersed audience of healthcare professionals (HCPs) to adopt a new therapy. The reluctance can be especially pronounced when the new therapy requires a behavioral shift from prescribing pharmaceuticals to referring patients to the hospital for an interventional device implant.

Sales reps aren’t enough to make it work

Sales reps aren’t enough to make it work

Many leaders’ first instinct is to flex their biggest, most well-developed commercial muscle by building an in-person sales team to engage with potential referrers. However, the scale and fragmentation of a typical referrer base makes this route a very challenging one. Few medtech companies can afford to invest in the necessary “army” of reps that pharmaceutical companies have at their disposal. As a result, some medtech sales leaders have instead tried diverting their teams out of hospital or surgical settings, attempting to drive demand with local referrers. This strategy is risky. Often even the best device sales reps are uncomfortable outside the hospital: not only are they tasked with engaging unfamiliar customers, but meanwhile they worry about gains that competitor reps are making back at the hospital while their backs are turned.

Access constraints in office settings are also much more restrictive than in hospitals, and the COVID-19 pandemic has only exacerbated the problem. ZS research shows that the volume of HCPs interactions with manufacturer sales representatives remains 20-30% below pre-pandemic levels.

Disconnected digital deluge

Disconnected digital deluge

Medtech marketers faced with these challenges have begun investing in digital tactics to engage with their target HCPs. But innumerable pharmaceutical and medtech companies are meanwhile vying for these same HCPs’ attention, bombarding them with multi-channel outreach. ZS’s AffinityMonitor and AccessMonitor benchmarking analyses show that the average U.S. HCP receives nine to 10 touches each day, and many doctors who are high-potential targets for multiple companies receive double that volume. Medtech companies are therefore finding that their investments in digital tactics are not having an impact; they are instead being drowned out by pharma companies who are not only spending more to reach these audiences, but are also developing increasingly sophisticated ways to engage HCPs with omnichannel models of in-person, digital and hybrid outreach.

As medtech investment in digital tactics increases in an attempt to drive market development at scale, leaders are pausing to ask whether the strategy is working, and what impact these investments are having on their business. Often they are disappointed by what they find. ZS observes a common set of challenges that are limiting the impact for many medtech companies today:

Disconnected channels and tactics create a fragmented customer experience

- Marketing campaigns are deployed as disparate tactics across numerous digital channels, without sufficient connection or synchronization across channels. This issue can be exacerbated when a field-based sales team is also engaging with the same target audience, since these teams typically work in a siloed fashion, with limited visibility into customer engagement in any other channels. This fragmentation creates a frustrating experience for customers and may limit the impact of the medtech company’s investment in digital marketing.

Broad-brush campaigns do not personalize messaging for HCPs

- Many companies that are just starting their digital engagement strategies deploy broad-based campaigns across a single target list and lack the ability to customize campaigns to customer segments no matter how large or diverse the set of customers that list represents. For example, a highly active referring physician who already believes in the value of a particular therapy might receive digital messaging focused on introducing the therapy; this content is a mismatch for such an important customer. Such broad-based campaigns are furthermore unable to adapt to customers’ preferences for engagement channels: repeated emails to a customer who doesn’t like to engage by email, for instance, risks creating negative attitudes to the brand or the therapy, hindering the company’s market development goals.

Key performance indicators are either missing or non-actionable

- Many marketers find themselves unable to derive insight into which market and therapy development tactics are driving maximum impact, either because the data is missing or unavailable at a granular level, or not unified into a single “360-degree” view of the customer.

- Other marketers focus on quantifiable KPIs including open-rate or click-through-rate, but even these measurements provide an insufficient view that focuses on tactical channel silos rather than on the overall customer experience. These issues are often further compounded by an ad-hoc approach to campaign measurement and the absence of internal resources and expertise to support the measurement and analytics.

- Facing such fundamental challenges, most marketers can only dream of conducting analytics that optimize both campaign deployment and the customer experience in real time, such as by adapting deployment to individual customers (or segments) based on either their previous engagement and preferences across channels and content or on their referral patterns.

Case study: Understanding and optimizing omnichannel engagement

Case study: Understanding and optimizing omnichannel engagement

ZS recently helped a medtech company to understand and optimize their omnichannel referrer engagement strategy. Our longitudinal analysis of their engagement patterns with referring HCPs highlighted how the company was creating a fragmented and disconnected experience across channels: rep calls were made inconsistently, a high volume of emails sent within the space of 10 days went unopened by the customer and the same display ads were served repeatedly. Importantly, none of these tactics were tailored to customers or customer segments. The campaign content and messaging was the same as for every target referrer and non-referrer alike.

By mapping and analyzing the customer experience across channels, ZS helped this company to recognize the necessary levers for moving away from a “channel-focused” engagement model and to design an improved omnichannel engagement strategy for their referrers. We then developed an algorithm to identify high-performing sequences across digital and personal channels, driving a better customer experience and further improving referrer impact. We confirmed through data analysis that the combination of digital and in-person touches typically resulted in greater customer engagement impact than did back-to-back sales rep calls, validating the omnichannel approach. The two most significant lessons to emerge about optimizing the impact and sequencing of referrer engagement across channels were:

Orchestrated digital marketing follow-up is 1.4x more impactful

Digital touches following a rep engagement drive significantly improved customer engagement with the digital content compared to emails received “out of the blue.” Customers are much more engaged with content that is relevant and connected to a recent rep interaction.

Optimal sequencing doubles the impact of digital marketing

Digital push tactics in isolation often fail to engage customers, regardless of the investment required or the volume of touches. But digital push tactics triggered and orchestrated after a customer responds to digital pull tactics have a significantly higher impact on customer engagement levels.

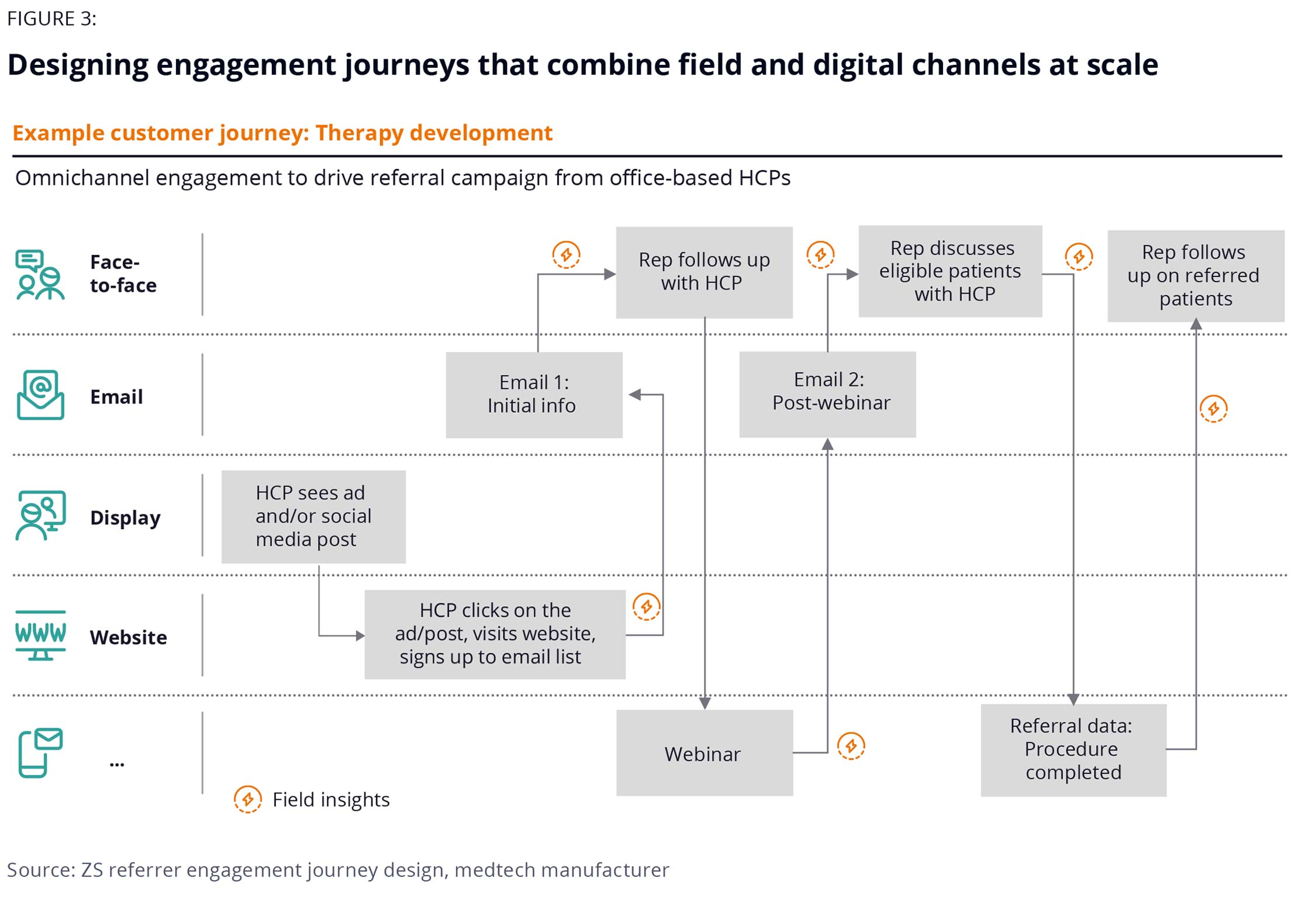

Ultimately the company used these insights to design simple engagement journeys that combine field and digital channels at scale to drive improved customer engagement for referrers.

An example engagement journey is shown in Figure 3. Each step in the journey is connected to the customer’s activity in other channels. For example, when the customer engages with the manufacturer’s digital content, this triggers follow-up actions via other digital channels (such as email) and via the rep, maximizing the engagement impact of each touchpoint. Furthermore, an intelligent “Field Insights” capability delivers suggestions to the field sales reps to enable them to engage with the customer with the right message, at the right time, to create a connected omnichannel experience for that customer. By integrating referral and procedure data into the customer data platform, the engagement triggers and content can be further tailored and adapted based on each individual HCP’s referral patterns and behaviors. Key performance indicators were designed to measure customer engagement and outcomes at each step in the journey, giving the marketing team much deeper visibility into the campaign performance and customer insight.

The future of medtech referrer engagement is omnichannel

The future of medtech referrer engagement is omnichannel

This case study shows the potential for medtech companies to use customer data to drive significantly greater impact from their marketing and sales investments, for both therapy development and referrer engagement. While most medtech companies are just getting started today, we observed that engagement that is increasingly personalized and automated through analytics will help medtech companies to stand out from their peers and competitors and to reach their referrer audiences.

To make progress toward an omnichannel model of customer engagement for market development, medtech companies will need to focus on three core capabilities.

- Customer strategy: design specific "omnichannel journeys" for campaigns and customer engagement, informed by customer insights and segment-level strategy and supported by analytics of current customer engagement across channels. For many medtech marketers, this change requires approaching the campaign design process in a new way.

- Organization and operating model: strong cross-functional collaboration between marketing, field sales teams, digital operations and analytics teams is essential to enabling the successful execution of an omnichannel engagement campaign.

- Data and analytics: at the heart of successfully executing omnichannel engagement are high-quality customer-level data and analytics to continuously measure campaign performance and to optimize tactics, enabling personalized engagement at scale and consistent orchestration of campaign execution across channels and customers.

To drive success quickly with omnichannel engagement, medtech companies should be pragmatic in establishing their near-term priorities. For most companies, that means using the available insights, data and infrastructure to develop and deploy simple campaigns to engage customers across channels, and carefully supporting the execution process to maximize their chances of success. By measuring the impact of these early moves, companies can build the case to further scale-up investment in differentiated omnichannel engagement to drive market and therapy development strategy.

Add insights to your inbox

We’ll send you content you’ll want to read – and put to use.

Add insights to your inbox

We’ll send you content you’ll want to read – and put to use.